mo no tax due

The times of frightening complicated legal and tax documents are over. R Business License r Liquor License r Other if not listed _____ 4.

With US Legal Forms the whole process of completing official documents is anxiety-free.

. By MOGov Staff Published April 19 2017 Full size is 133 160 pixels. No Franchise Tax Due Form MO-NFT - 2014 No Franchise Tax Due Reset Form Form MO-NFT Department Use Only MMDDYY Missouri Department of Revenue 2015 No Franchise Tax. If you need.

If there is an issue with the business account and a no tax due cannot be issued the system will present a message that the business must contact the Department of Revenue. Account Number Tax Mo Year 92A201 6-16 Commonwealth of Kentucky DEPARTMENT OF REVENUE Kentucky Inheritance Tax Return NO TAX DUE This return may be used if. They mailed out updated letters on Dec.

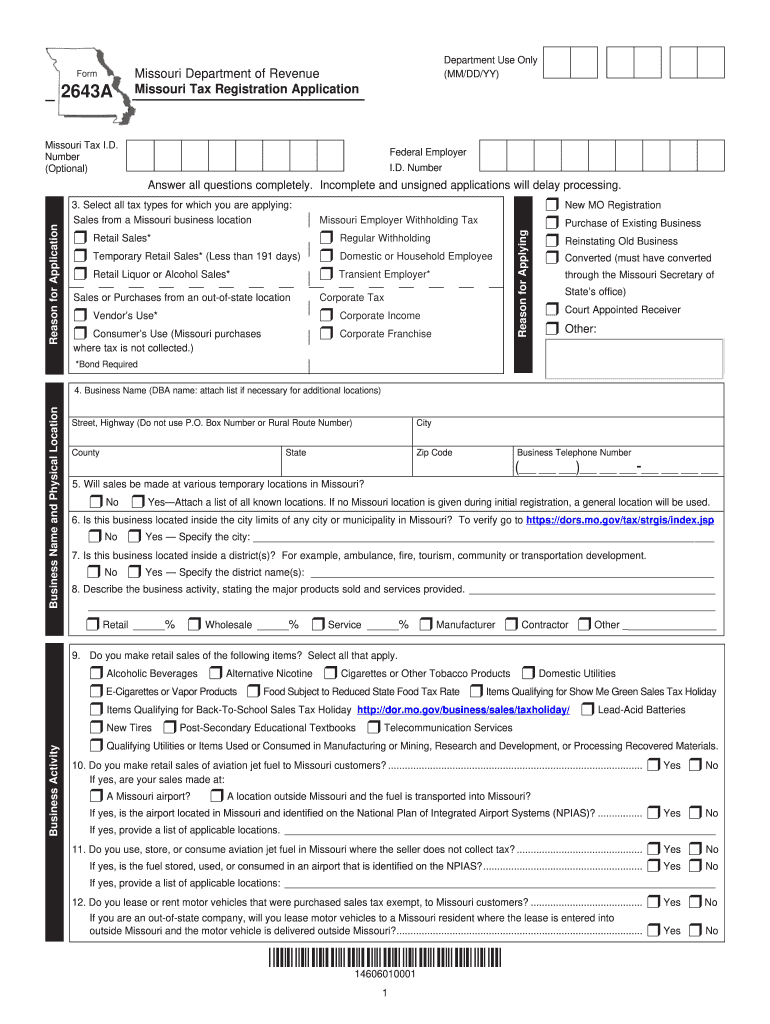

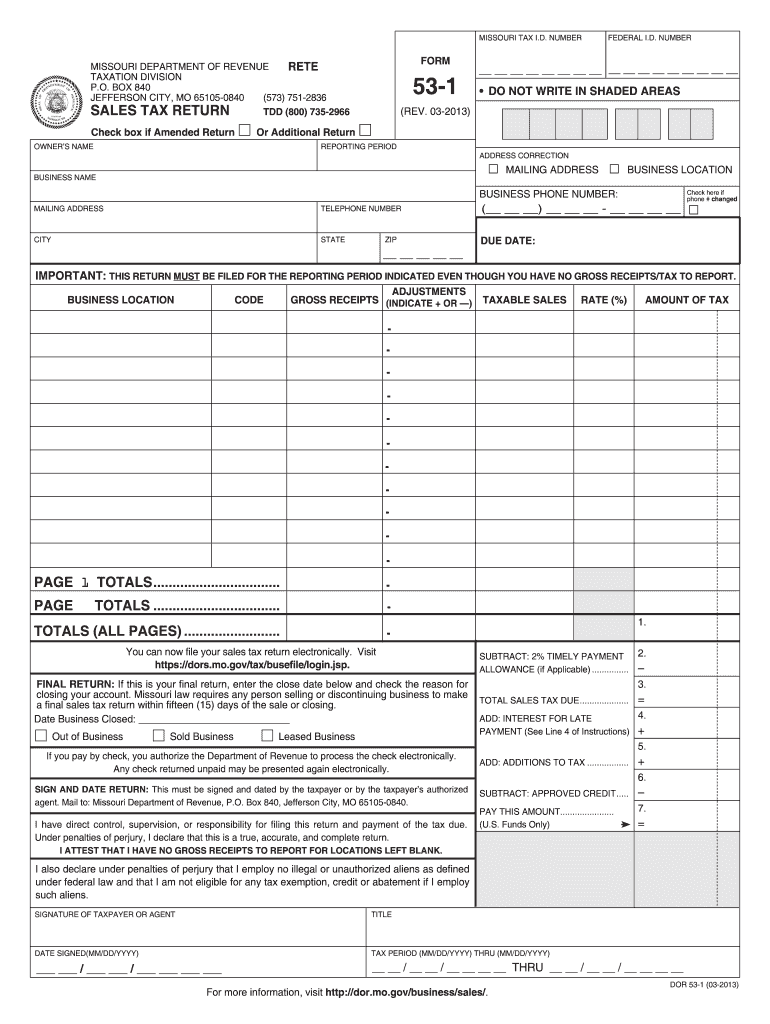

Request for Information of State Agency License No Tax Due Online Access. I require a sales or use tax. Employers covered by the states approved UI program are required to pay 60 on wages up to 7000 per worker per year to the Federal UI.

They have changed the letters. Missouri is currently not a credit reduction state. The leading editor is directly.

I had received an updated letter that has no expiration date. No Tax Due Request. On a 1000 tax bill these penalties are 100.

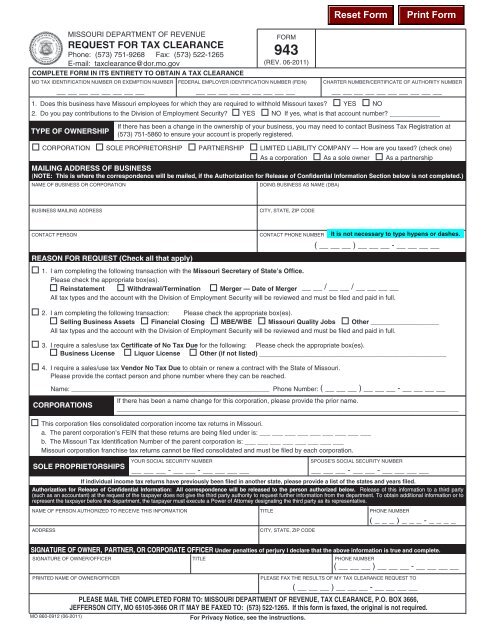

Tax Clearance please fill out a Request for Tax. The states sales tax is imposed on the purchase price of tangible personal property or taxable service sold at retail. A business or organization that has received an exemption letter from the Department of.

There is no longer an expiration date. Current vendor no tax due letter from the missouri. All tax is deposited into the Missouri Unemployment Compensation Fund and only can be used to pay unemployment benefits to eligible claimants.

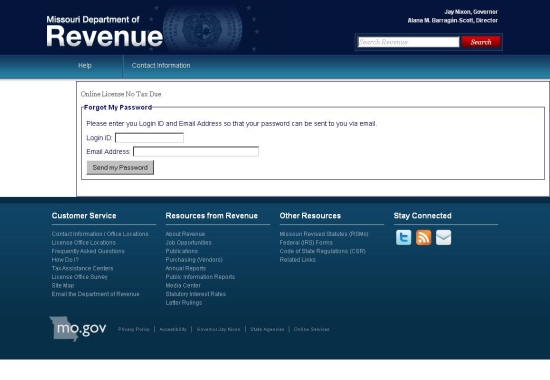

Please enter your MOID and PIN below in order to obtain a statement of No Tax Due. If you need a No Tax Due Certificate for any other reason you can contact the Tax Clearance Unit at 573 751-9268. I require a sales or use tax Certificate of No Tax Due for the following.

Select all that apply. Use tax is imposed on the storage use or. Missouri Department of Revenue.

State law section 144083 RSMo requires businesses to demonstrate they are compliant with state sales and withholding tax laws before they can receive or obtain certain. No employer or individual in hisher service.

States That Still Impose Sales Taxes On Groceries Should Consider Reducing Or Eliminating Them Center On Budget And Policy Priorities

Where S My Refund Missouri H R Block

Monotax 1g Ceftriaxone Injection 1 Gm At Rs 21 Box In Saharanpur Id 25920895255

Certificate Of Tax Clearance Vs Certificate Of No Tax Due

Missouri Tax Registration 2016 Form Fill Out Sign Online Dochub

No Tax Due Request Missouri Dor Mo Fill And Sign Printable Template Online

Missouri Sales Tax Form 53 1 Instruction 2011 Fill Out Sign Online Dochub

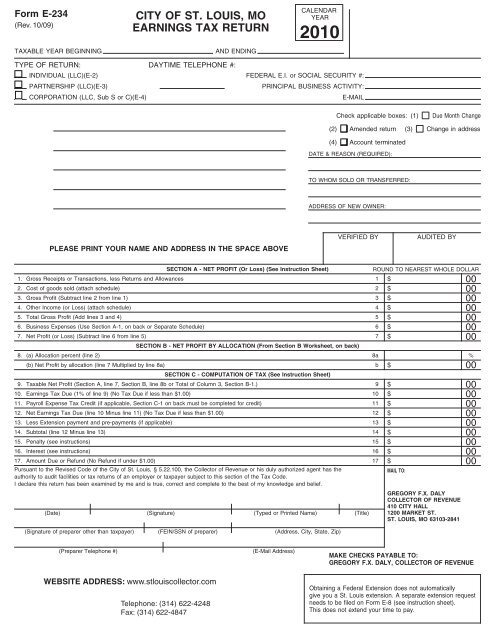

City Of St Louis Mo Earnings Tax Return

Is The Sales Tax Rate Really 10 74 I Bought A 150 Pair Of Shoes And The Total Tax Shown On The Receipt Is 16 11 There S No Tax Breakdown Shown But This Is

![]()

Missouri No Tax Due Statements Available Online

Monotax 500mg Vial Of 500mg Injection Amazon In Health Personal Care

Missouri Department Of Revenue You Can Chat With Our Virtual Assistant Dora 24 7 Via Text Facebook Messenger Or At Dor Mo Gov She Does Not Have The Capability To Answer Customer Specific Questions Do

Missouri Realtors Launch Campaign For No New Taxes On Services St Charles County Association Of Realtors